Permanent Account Number or PAN card issued by the Income Tax (IT) departments is witnessing a total revamp and changes at lightning fast speed. Income Tax department had issued some new guidelines which one needs to keep in mind before applying for a new PAN or getting some corrections done to an existing PAN. The new guidelines are framed not just to check tax evasion but also provide greater flexibility. The deadline for the same is approaching soon.

Here are few features which must not be ignored, if you have missed it somehow.

Last date for application for entities.

All entities which have made transactions equivalent or above Rs. 2.5 lakh must apply for PAN card before 31st May, 2019, which being the last date. Notification regarding the same has been published by Central Board Of Direct Taxes (CBDT). This is the final deadline.

Quoting of Father’s name no more mandatory

As per the newly published rules quoting of father’s name has been withdrawn in application form by applicants raised by single mothers. The applicants exercising the option of only having their mother as his/her parent would be given the option to furnish the name of the mother alone.

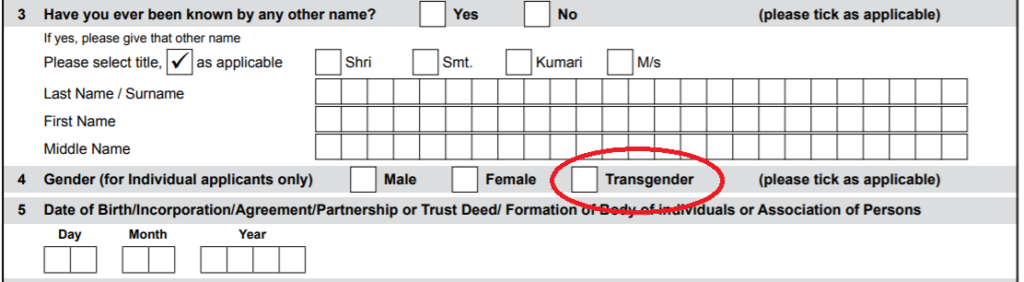

Addition of third gender

The CBDT has added the option of listing one’s gender as transgender in the gender column of the Form 49A/49AA. Now this addition to existing option of ‘male and female’ will promote equal rights and inclusiveness.

Also read: PAN cards now with enhanced Quick Response Code

Compliance by Non-individual entities

An amendment has been made to section 139A of the Income Tax Act, as per a 2018 budget suggestion, which requires all non-individual entities who have made transactions worth Rs. 2.5 lakh to apply for PAN card by May 31, 2019. This implies that a Hindu Undivided Family (HUF) that has conducted transactions of Rs. 2.5 lakh or more than that in the year 2018 are required to apply for PAN by the end of May, 2019. Any individual, recognised as the managing director, director, partner, trustee, founder, partner, office-bearer, CEO, karta, principal officer or any individual authorised to represent the entity who has not been allotted any PAN is required to apply for the same before May 31 of the following financial year.

Another big revamp to PAN card services as quoted by CBDT chairman Sushil Chandra is that soon it will be possible to execute the allotment of the PAN in four hours. Sushil Chandra also mentioned that the CBDT was planning to introduce automated measures such as pre-payment of taxes, filing of IT returns, refunds, case selection, finalization of cases for scrutiny and so on.

[…] PAN card features not to be missed […]

[…] PAN card features not to be missed […]