Summary: -PAN of both parties needed i.e. buyer and the seller for making e-payment of TDS on purchase of property.

-The TAN (Tax Deduction Account Number) is not required for payment of tax and issue of Form 16B. -TDS to be paid by purchaser and not seller.

The real estate sector in National Capital Region (NCR) is showing an upward trend after implementation of UPRERA. Buyers sentiments seems positive after announcement in budget for FY 2019-20 extending benefit u/s 54 on purchase of second home and also scrapping notional rental income from second home.

So, if you are planning to buy second house the value of which is Rs. 50 lakhs or more, then this piece of information is important for you.

When applicable

The purchaser of an immovable property (whether constructed or under construction) of value Rs 50 lakh or more is liable under the I-T Act to pay tax of 1% from the sale consideration payable to the seller.

Due date to deposit TDS witheld: The due date of payment of TDS is 30 days from end of the month in which the deduction is made. Date of deduction will be the last payment made to seller, if payments are made in installments or through bank loan. (Usually in case of flat booked from real estate developers)

Also remember, at the time of making final payment deduct the TDS from the final payment. Many individuals make the mistake of paying the TDS from their own pocket and the credit goes to the seller. This actually leads to double payment which later becomes a matter of adjustment or contention.

Pre-requisites: PAN of both parties i.e. the buyer and the seller is mandatory to make payment of TDS on sale of property.

There is no need of TAN (Tax Deduction Account number) as the buyer is usually individual buying property for his use.

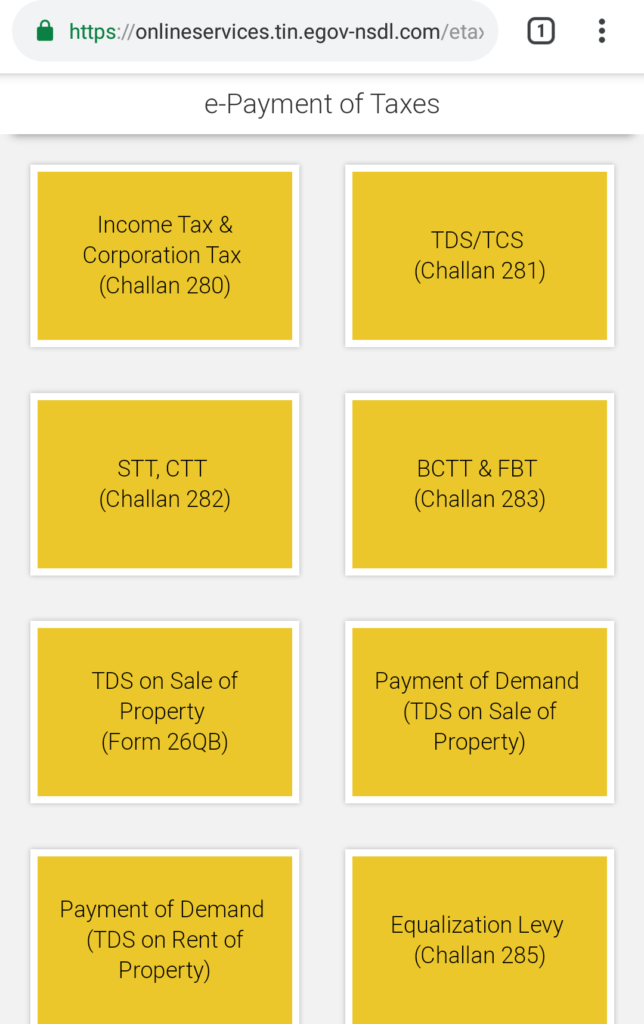

The payment can be made online by the buyer on the following link:

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

In case you find it difficult them you can hire a professional for the same. Tax payment will be made using Form 26QB.

Form 26QB: The buyer is required to fill an online form, 26QB before the final tax payment is made online. The PAN of the buyer and seller, details of the property, total consideration payable, and payment details must be furnished in Form 26QB for payment of tax.

The amount of TDS that needs to be paid is calculated on the amount paid/payable to the seller.

The tax payment can be made via net banking portal or by visiting authorised bank branches. Once the payment is executed, an acknowledgement number is generated. On entering the acknowledgment details at a later date, usually after 2 days, one can generate the submitted Form 26QB for records.

Issue of Form 16B: Once tax payment is made the buyer needs to iaaue Form 16B to the seller. Form 16B is TDS certificate that seller can use to claim the TDS deducted. This can be downloaded from the website of Centralised Processing Cell of TDS (CPC-TDS) at www.tdscpc.gov.in

The buyer should register an account with TDSCPC for downloading this form 16B. The real estate developer of seller will not transfer the property papers until the TDS payment is made and Form 16B issued to him. Only father that final property registration will take place.