Everyone knows that one can pay off the entire personal loan after a certain limit of time, but very few know that now you can also make part prepayment of your personal loan in the same way it is done in case of home loans.

It is because the same is never told to you by the bank or the agent facilitating your loan. Has your bank ever told you at the time of sanctioning or disbursing the personal loan that, you can make part payment of personal loan without any charges or penalty. Yes, you read it right, there is no penalty on part payment charges if you make payment to the bank in lump sum, provided the personal loan sanctioned is at a floating rate of interest. Most of the banks will not offer you a floating rate of interest, even if they can. Banks will offer you a fixed rate of interest all the time. You will have to ask and get the loan at a floating rate of interest in case you want to make early payment and save on interest as well as charges.

Part Payment:

If you have lumpsum idle money lying with you then it is advisable to part payoff the personal loan if not fully.

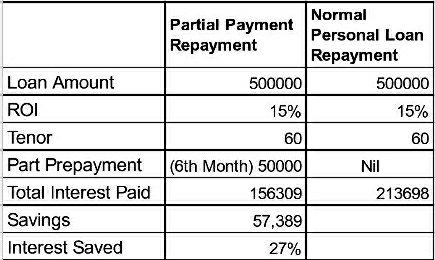

Part payment will bring down the principal amount, which in turn will bring down your EMIs and the total interest you pay. However, it is important to keep in mind to make a handsome amount of part payment, at least for 4 to 12 EMI equivalent.

It is the best way to save on your interest amount as the part-payment amount goes to directly reduce the Principal Outstanding as on date/month of making the partial payment.

Example:

Personal loan part payment need not be only once. It can be more than once and can even be a regular payment of a lump-sum amount. This will bring down the EMI amounts as well as the total interest paid. Even if prepayment charges are paid for every transaction and the amount is paid back regularly, the benefits of a reduction in total interest paid will be much more compared to the charges paid.However, the biggest drawback of part payment is that many banks do not allow it when it comes to personal loans. Banks/NBFCs have a lock-in period on the term (Min. 6 to 12 EMIs) and the amount of part payment (either the Multiple of EMI or % of Principal Outstanding)

Eg. HDFC has the following conditions for personal loan part repayment:

– Lock in period of 12 months

– Only 25% of the outstanding principal can be paid off at a time

– There are part payment charges in case of the fixed rate of interest which goes up to 5% of outstanding principal.

– Part payment can be done only twice during the tenure of the loan.

– Applicable for loans booked after 1st April 2018.

Other banks may have different part payment policy.

Impact on credit rating:

If you prepay a personal loan, then it does not have an immediate effect on your credit rating. Although in the long run a full prepayment effectively enhances your credit rating. On the other hand, part payment of a loan has no immediate or long-term effect on your credit rating barring the fact that it reduces your total loan burden.

If we follow an old adage saying that “one should borrow as little as possible and repay as quickly as possible”. This holds particularly true for personal loans, which with their high rate of interest can be a big burden on your finances.